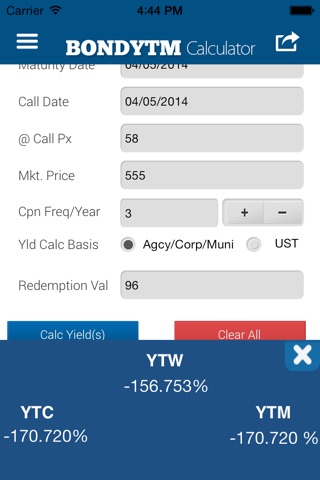

Bond YTM Calculator

A bonds YTM, or yield to maturity, is a way to calculate your potential return when investing in a bond. Unless you buy a newly issued bond, you will most likely buy it for more or less than its face (par) value and you probably wont hold it to maturity. Therefore, your actual rate of return might be higher or lower than the coupon rate (stated annual interest rate). Yield is always expressed as a percentage.

Yield to maturity, rather, is simply the discount rate at which the sum of all future cash flows from the bond (coupons and principal) are equal to the price of the bond.

Know that yield to maturity measures a bonds yield from the day you buy it until its maturity date, the date when you redeem the bond for its full principal.

The yield is usually quoted without making any allowance for tax paid by the investor on the return, and is then known as "gross redemption yield". It also does not make any allowance for the dealing costs incurred by the purchaser (or seller).

•If the yield to maturity for a bond is less than the bonds coupon rate, then the (clean) market value of the bond is greater than the par value (and vice versa).

•If a bonds coupon rate is less than its YTM, then the bond is selling at a discount.

•If a bonds coupon rate is more than its YTM, then the bond is selling at a premium.

•If a bonds coupon rate is equal to its YTM, then the bond is selling at par.

In new features now you are able to store your calculation for future, also you can send that calculation as a mail to your relative or your friends.